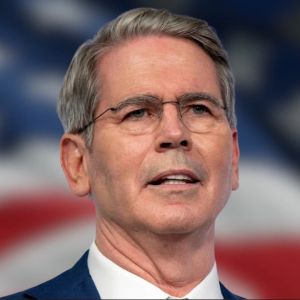

BitcoinWorld Death Spiral Alert: Peter Schiff’s Chilling Warning About Strategy’s Preferred Stock Risk Renowned Bitcoin skeptic Peter Schiff has issued a terrifying warning that could send shivers down any investor’s spine. His latest analysis points to a potential death spiral scenario for Strategy, raising serious concerns about the company’s financial stability. What Exactly is This Death Spiral Schiff Warns About? Peter Schiff claims Strategy’s entire business model depends on income funds buying its high-yield preferred stock. However, he argues these promised yields might never materialize. The moment funds realize this truth, they could trigger a catastrophic chain reaction. Imagine this scenario: multiple funds simultaneously dump their preferred stock holdings. This creates a massive supply glut that crashes prices. Strategy then cannot issue more stock to raise capital, creating the perfect conditions for a financial death spiral. Why Preferred Stock Creates Such Dangerous Exposure Preferred stock sits between common stock and bonds in the capital structure. While it offers higher yields, it carries significant risks that many investors underestimate. Schiff highlights several critical vulnerabilities: Dependence on continuous market confidence High yield promises that may be unsustainable Concentrated ownership among income funds Limited liquidity during market stress The potential death spiral becomes inevitable when these factors combine during market uncertainty. Investors should understand that high yields often come with hidden dangers. How Can Investors Protect Themselves? Schiff’s warning serves as a crucial reminder for all investors. When evaluating high-yield investments, consider these protective measures: Diversify your portfolio across different asset classes Research the sustainability of promised yields Monitor concentration risks among major holders Understand the capital structure and your position in it The looming death spiral scenario emphasizes why due diligence matters more than ever in today’s volatile markets. What This Means for Crypto and Traditional Investors While Schiff specifically targets Strategy’s preferred stock, the lessons apply broadly. Both cryptocurrency and traditional investors face similar risks when chasing high yields without understanding the underlying mechanisms. The potential death spiral in traditional finance mirrors risks in decentralized finance. Over-leverage, dependency on continuous capital inflow, and concentrated ownership can create systemic vulnerabilities in any financial system. The Bottom Line: Schiff’s Sobering Reality Check Peter Schiff’s analysis delivers a powerful warning about financial stability and risk management. The death spiral scenario he describes serves as a cautionary tale for all investors chasing high yields without proper risk assessment. Whether you invest in traditional stocks, preferred shares, or cryptocurrencies, understanding structural risks remains paramount. Sometimes, the highest yields come with the greatest dangers of collapse. Frequently Asked Questions What is a death spiral in finance? A death spiral occurs when declining asset prices trigger forced selling, which causes further price declines in a destructive feedback loop that can collapse an entire financial structure. Why is preferred stock risky? Preferred stock carries risk because it depends on company stability for dividend payments and lacks the safety of bonds or the growth potential of common stock during good times. How accurate are Peter Schiff’s predictions? While Schiff has made some accurate economic warnings, he’s also been wrong about Bitcoin’s complete failure. Investors should consider multiple perspectives before making decisions. Can death spirals be prevented? Yes, through proper risk management, diversification, and avoiding over-concentration in any single investment or asset class that depends on continuous market confidence. What alternatives exist to high-yield preferred stock? Investors can consider diversified bond funds, dividend-paying common stocks with strong fundamentals, or properly researched cryptocurrency projects with transparent tokenomics. How does this relate to cryptocurrency investments? Similar death spiral risks exist in crypto through mechanisms like leveraged positions, algorithmic stablecoins, and projects dependent on continuous new investment to sustain yields. Found this analysis helpful? Share this crucial warning with fellow investors on social media to help them avoid potential financial traps. Knowledge sharing protects our entire community from unseen risks. To learn more about the latest cryptocurrency trends, explore our article on key developments shaping Bitcoin price action and institutional adoption. This post Death Spiral Alert: Peter Schiff’s Chilling Warning About Strategy’s Preferred Stock Risk first appeared on BitcoinWorld .