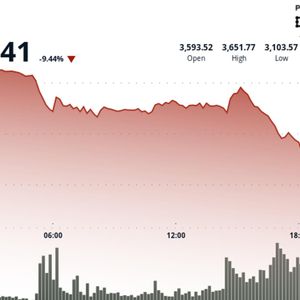

Even though the price of Cardano has shown robust weakness over the past few days, the network’s activity remained strong, delivering a notable performance during this period. A recent report has revealed that the leading blockchain has experienced a sharp growth in terms of Adjusted On-chain Volume. Surge In Cardano’s Adjusted Transaction Volume The leading Cardano network appears to be significantly growing and thriving in the midst of ongoing bearish price performance, which has caused ADA to fall back to the $0.60 mark. In a post on the social media platform X, TapTools has outlined the blockchain resilience as its Adjusted On-chain Volume explodes. According to the expert, the network has processed more than $6 billion in adjusted on-chain volume as of Thursday. The on-chain volume ultimately reached the aforementioned value after attracting a more than 21% increase. Specifically, the kind of growth highlights a fresh wave of network activity, indicating that both traders and long-term holders are shifting their positions. As ADA responds to changes in the larger cryptocurrency market, this uptick is likely a sign of rising liquidity and network usage. It is worth noting that Cardano recorded a massive rise in adjusted on-chain volume despite the number of active addresses on the blockchain seeing a slight decline. Data shared by TapTools shows that the total number of active addresses is currently situated at around 21,930 following a 2.71% drop on Thursday. This slight drop in active addresses on the blockchain may suggest that short-term users are taking a step back due to the shifting market environment. The chart also showed other key metrics such as Top 100 Holder Share, Net Unrealized Profit and Loss, STH vs LTH Supply Distribution, among others. Cardano’s Top 100 holder share currently stands at 29.04% while its net unrealized profit and loss is at the 0.05 level. Meanwhile, the STH vs LTH Supply Distribution shows 48% of short-term holders are distributing, and 52% of long-term holders are distributing. Growing Institutional Demand Towards ADA Cardano’s price decline has not hindered institutional demand for ADA, as evidenced by the notable accumulation from American-based cryptocurrency exchange, Coinbase. Coinbase is doubling down on the altcoin, with its cbADA proof of reserves surging to 17.48 million ADA. TapTools highlighted that the platform acquired over 9.56 million ADA in less than a month, bringing its total supply held to 17.48 million ADA. This move up represents an 83% increase in wrapped Cardano holdings, which suggests that on-chain demand continues to accelerate. During this period, ADA’s Open Interest on Coinbase also experienced an increase. Data from TapTools shows that ADA’s open interest on the platform rose to $2.2 million. According to TapTools, this rise in open interest is another sign of increasing demand in the Cardano market.